Can I Use the Va Loan Again After Doing an Irrrl

What is the VA IRRRL ?

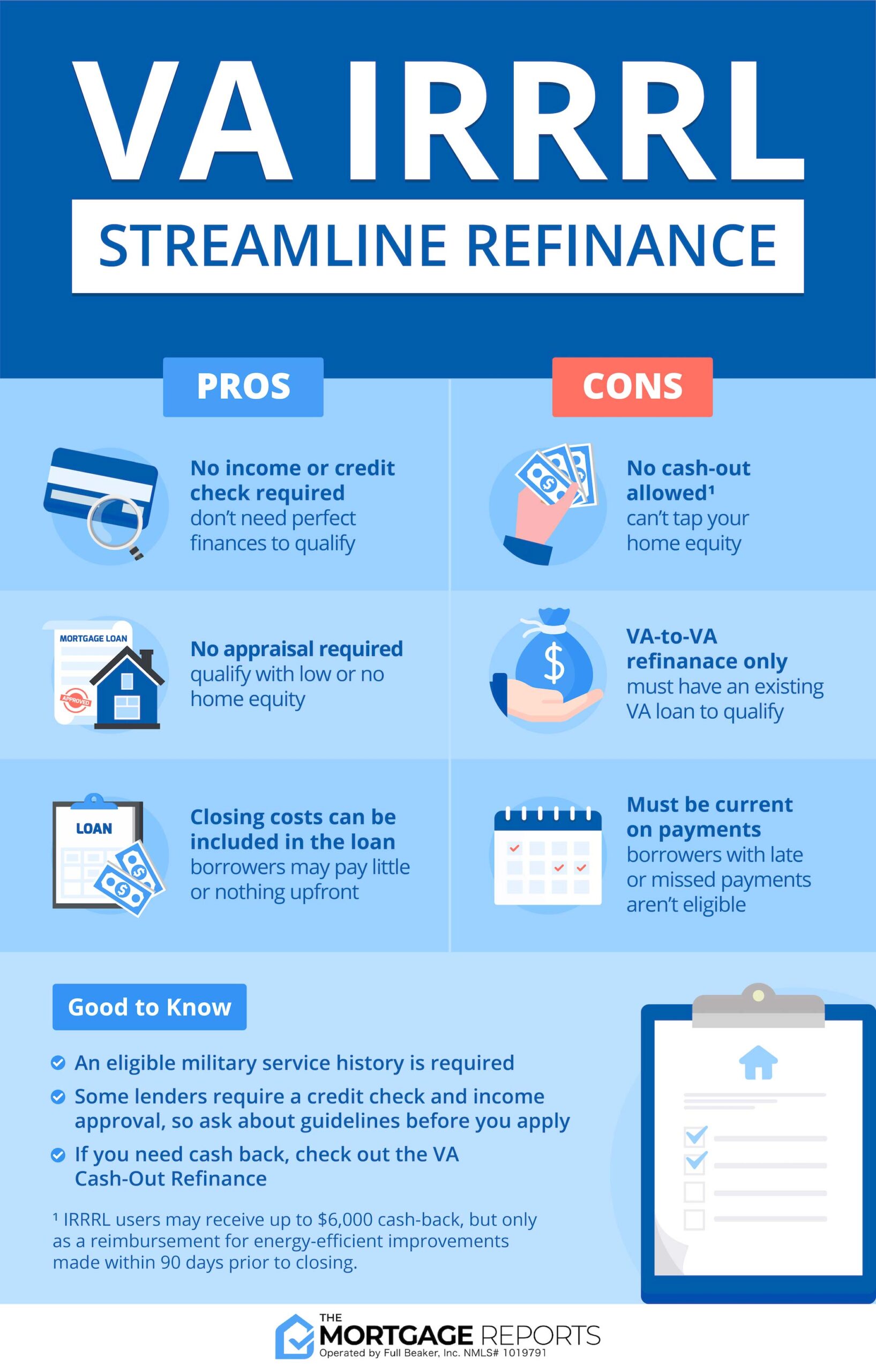

The VA IRRRL is a simple way to refinance your current VA loan into a lower rate and monthly payment.

IRRRL stands for "VA Interest Charge per unit Reduction Refinance Loan." This loan program is also known every bit the VA Streamline Refinance or a VA-to-VA refinance.

With the VA IRRRL, there's less documentation (no credit, income, or employment verification) and you lot might non need an appraisement. Closing costs also tend to exist lower, and can be rolled into your loan to eliminate upfront charges.

This IRRRL information is authentic as of April 6, 2022.

In this article (Skip to…)

- VA IRRRL rates

- How it works

- IRRRL benefits

- Guidelines

- VA Streamline lenders

- IRRRL vs. VA cash-out

- VA Streamline FAQ

VA IRRRL rates today

VA IRRRL rates are some of the best mortgage rates on the market.

Thank you to backing from the Department of Veterans Affairs, lenders can offer exceptionally low interest rates on these loans.

VA IRRRL rates today, April half dozen, 2022

| Loan Type | Today's VA Refinance Rate |

| VA xxx-twelvemonth stock-still-rate | % (% APR) |

| VA 15-year fixed-rate | % (% APR) |

| VA v/1 ARM | % (%) |

Today'southward starting rate for a 30-yr VA IRRRL is % (% Apr), according to our lender network*.

Compare that with % (% Apr) for a conventional loan, and you lot can run across there are serious savings to be had with VA IRRRL rates.

Of course, VA refinance rates vary by customer. Your rate will likely exist higher or lower than average depending on your loan size, credit score, loan-to-value ratio, and other factors.

*Interest rates and annual percentage rates for sample purposes only. Average rates presume 0% down and a 740 credit score. See our full loan VA rate assumptions here.

How the VA IRRRL works

Like any mortgage refinance, the VA IRRRL programme replaces your existing mortgage with a new loan. The new loan starts fresh at xxx or 15 years, depending on which loan term you cull.

But the process for a VA Streamline Refinance is a piffling different from a traditional refi.

Because in that location'southward no income, employment, or credit verification required, borrowers have less paperwork to handle. And y'all don't need a new Certificate of Eligibility (COE), because the IRRRL can only be used on an existing VA loan. And so the lender already knows you're VA-eligible.

Finally, there'due south no domicile appraisal. This tin can shave a week or more off your loan's underwriting fourth dimension — so VA Streamline loans typically close faster than other refinances.

Is the VA IRRRL plan worth it?

As with any refinance, using the VA IRRRL results in a brand new loan. So your mortgage will start over at 30 or 15 years, depending on which loan term y'all choose.

But using the VA IRRRL is worth information technology for many homeowners.

That'southward because today'due south ultra-low VA rates tin result in a much lower monthly payment and potentially relieve you thousands in involvement payments in the long run.

Another big benefit? VA loan endmost costs can be rolled into the loan. This allows veterans to refinance with few or no out-of-pocket expenses.

Sometimes it is also possible for the lender to absorb your loan costs in exchange for a higher interest rate on your loan.

Benefits of a VA Streamline Refinance

The VA IRRRL lets veterans and service members refinance their electric current mortgage loan to a lower rate and monthly payment.

The biggest benefits of the VA Streamline programme compared to other refinance options are:

- Express paperwork

- Depression interest rates

- No individual mortgage insurance (PMI)

- Appraisal typically non required

- May exist able to refinance with niggling or no disinterestedness

- You might have low or no closing costs

- A low credit score won't disqualify you

- Available to most veterans and active-duty members of the armed forces from all branches, including many Reserves and National Guard members

The VA Streamline loan program is extremely popular because information technology's piece of cake to utilize.

If you already have a VA mortgage on your dwelling, the IRRRL program makes refinancing to a lower rate relatively quick and painless.

However, lenders tin ready their own requirements for credit checks and appraisals. So if you want to skip these steps, be certain to store around and ask about lenders' policies before you use.

VA IRRRL guidelines

To authorize for a VA Streamline Refinance (IRRRL), your current mortgage must be a VA abode loan.

Homeowners must likewise meet underwriting requirements gear up by the Department of Veterans affairs.

Current guidelines for the IRRRL include:

- You are current on payments with no more than one 30-mean solar day late payment within the past yr

- Your new rate and monthly payment for the IRRRL must be lower than the previous loan's monthly payment. The only time this condition does non employ is if you refinance an ARM to a fixed-rate mortgage

- You lot must non receive any cash from the IRRRL

- Y'all must certify that yous currently or previously occupied the property

- You must take previously used your VA Loan eligibility on the holding you intend to refinance. You may see this referred to as a VA-to-VA refinance

Y'all tin easily figure out if you meet the VA IRRRL guidelines by checking with your current mortgage lender, or whatsoever other lender that's authorized to practise VA loans (well-nigh are).

VA IRRRL lenders

It pays to shop around for the best lender when yous do a VA Streamline Refinance. And that'south because not all lenders have the same rules.

For instance, some lenders require credit and income approval even though the VA doesn't. And interest rates can vary a lot from one company to the next. And so depending on which lender y'all choose, you may or may not have access to the full suite of VA IRRRL benefits.

Not certain where to start? According to the Department of Veterans Affairs, these are the most popular VA loan lenders past book:

- Liberty Mortgage Company

- Quicken Loans

- Veterans United

- PennyMac

- Lakeview Loan Servicing

For more information on how to choose a VA IRRRL lender, bank check out our review of the Best VA Loan Lenders in 2022.

VA Streamline Refinance vs. VA cash-out refinance

Generally, homeowners are non allowed to get cash-back with the VA IRRRL program.

There's just one exception: IRRRL users may go up to $6,000 cash-back if they plan to utilise information technology for free energy-efficient dwelling house improvements.

For everyone else, there is a VA cash-out refinance loan.

A cash-out refinance allows borrowers to refinance their existing loan into a lower charge per unit while too taking cash from the home's value. This replaces your existing mortgage, instead of but withdrawing cash like a home disinterestedness loan.

A qualified borrower can refinance up to 100 percentage of the home'southward value (100% LTV) using a VA loan in some cases.

Another benefit is that the VA cash-out refinance can be used regardless of your electric current loan blazon — whether VA, USDA, FHA, or conventional.

Just similar the VA Streamline Refinance loan, the habitation must exist used as a chief dwelling by the owner.

There is no set catamenia of time that you must have owned your home, however, you must have plenty disinterestedness to authorize for the loan.

VA IRRRL FAQ

How much does the IRRRL cost?

Closing costs for a VA Streamline Refinance are like to other VA loans: ordinarily 1 to iii pct of the loan amount. Lenders may charge a loan origination fee upwardly to 1 percent of the loan'south value. However, yous may exist able to skip the dwelling appraisal, which tin can save around $500 to $1,000. Borrowers are charged a 0.five percent funding fee as well, which costs $500 for every $100,000 borrowed. This tin be rolled into the loan corporeality to avoid paying upfront.

Who has the best VA refinance rates?

VA mortgage rates are not controlled past the Section of Veterans Diplomacy. Rather, they're ready by the private lenders that offer these loans. That means VA refinance rates tin vary a lot from one lender to the adjacent. Rates are different for each borrower, so you need to store around for your best charge per unit. Compare personalized offers from at to the lowest degree 3-5 lenders to find the best deal.

How many times can you use the VA IRRRL?

In that location's no limit to the number of times you tin can utilise the IRRRL programme, equally long as you wait the required 210 days between each refinance and each 1 has a 'net tangible do good' (lowering your interest rate and monthly payment significantly). Refinancing involves closing costs and starts your loan over, so using the IRRRL repeatedly won't make sense for virtually homeowners.

How long does an IRRRL take?

The time information technology takes to refinance using an IRRRL varies a lot, depending on the borrower and lender. If all goes smoothly, a VA IRRRL might close in under a month — which is faster than about refinances. Notwithstanding, a complicated loan awarding or a busy loan officer can bog downward the process.

Can yous go greenbacks out on a VA IRRRL?

Merely under special circumstances. You may receive up to $vi,000 cash-in-manus at your IRRRL endmost. The cash MUST be used for energy-efficiency improvements, and must be a reimbursement for improvements made within 90 days prior to closing. Some VA borrowers will also receive cashback if they prepaid taxes and insurance on their previous loan, and some of those funds went unused.

Who qualifies for a VA IRRRL?

To qualify for a VA IRRRL, yous must have a current VA loan that'south been open for at least vii months (210 days). Y'all must besides be current on your mortgage payments, and the new loan must accept a articulate financial do good. Because the IRRRL is a streamlined refi program, lenders do non have to check your credit score, although some do anyways.

How before long tin can I do a VA IRRRL?

The VA requires you lot to wait 7 months (210 days) from your last loan closing before using the VA Streamline Refinance. However, some VA lenders impose their own waiting flow of upward to 12 months. If your current lender says information technology's too shortly to refinance your VA loan afterward vii months, it might be worth shopping for another lender that will let you refinance earlier.

Can you remove a spouse with the VA IRRRL?

In general, the borrower(south) obligated on the original VA loan must be the aforementioned as borrower(south) obligated on the refinance. However, there are a few exceptions, for example in the case of a divorce. An IRRRL is possible in all of the following scenarios: Divorced veteran solitary; Veteran and dissimilar spouse; and, surviving spouse lone because the veteran died. An IRRRL is non possible for a divorced spouse alone, or a different spouse lone because the veteran died.

What documentation is needed for the VA IRRRL?

The VA does not require a credit check or appraisal when using a Streamline Refinance. However, many lenders require a credit check and employment verification to guarantee you lot are still financially stable enough to pay your mortgage. Some lenders also require a new appraisal — merely since skipping the appraisal is one of the main benefits of an IRRRL, we encourage you to shop around if your lender requires one. A COE is not required, because the existing borrower has already been canonical for VA financing.

Does the IRRRL require a funding fee?

Yes, a VA funding fee is required for the VA IRRRL refinance. It'south 0.5 pct of the loan corporeality. You have the option to coil the funding fee into your loan when using the IRRRL, then you don't accept to pay it upfront in cash. Just call up, rolling the funding fee into your mortgage means you lot'll pay involvement on that corporeality over the life of your loan.

How do I become my funding fee waived?

Only select VA borrowers are eligible to have the funding fee waived. These include veterans receiving disability bounty; surviving spouses of veterans who died from a service-continued disability; veterans entitled to receive VA compensation for a service-connected disability, just who receive retirement pay or active duty pay; and active-duty service members who provide, on or before the appointment of loan endmost, evidence of having been awarded the Purple Heart.

Tin can I roll the funding fee into my mortgage?

Aye, the VA allows borrowers to roll the funding fee into their mortgage loan amount rather than paying it upfront. Keep in mind, this means you'll pay interest on the funding fee over fourth dimension.

Do I need to qualify for a better interest rate to apply a Streamline Refinance?

If you are going from a fixed-rate mortgage to another stock-still-rate mortgage, the VA requires your IRRRL to have a lower interest rate. Just if you are moving from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage, the VA will allow y'all to refinance to a college interest charge per unit.

What is the maximum VA IRRRL loan size?

There is no loan limit for a VA loan. Even jumbo loan sizes are allowed if the homeowner qualifies. However, a VA Streamline Refinance will be limited to the existing loan residue plus whatsoever accrued tardily fees and late charges, plus typical loan costs and the toll of whatsoever free energy efficiency improvements.

Can I use the VA Streamline Refinance for an investment property?

Yep, yous can utilise the VA Streamline Refinance for an investment property. You must certify that you previously lived in the holding equally your primary residence. However, you no longer need to exist living at that place full-fourth dimension at the time you refinance.

Can I buy discount points to lower my interest charge per unit?

The VA does allow you to purchase discount points to get a lower mortgage rate. Simply note, you can merely finance 2 discount points. Boosted points will require an upfront cash payment. Discount points typically cost i percent of the loan amount and lower involvement rates by almost 0.25 percent.

How does VA refinancing work?

Start by getting a preapproval to brand sure you're qualified for a VA refinance. Then, check rates from a few different lenders. You lot do not have to refinance with your current lender, and most people tin find an even lower rate and payment by shopping around. Once you choose a mortgage visitor, you'll submit your loan documents and get canonical. A VA Streamline Refinance requires less paperwork than other loan types, and may allow you skip the home appraisal.

Check VA refinance rates today

The VA Streamline Refinance is one of the simplest and fastest mortgage products available for consumers today.

Current rates are depression, and then it's a great time to take reward of your veteran benefits.

Check with top-rated and VA-canonical lenders for your refinance.

The data independent on The Mortgage Reports website is for informational purposes only and is not an advertisement for products offered by Full Beaker. The views and opinions expressed herein are those of the author and practise not reverberate the policy or position of Total Beaker, its officers, parent, or affiliates.

Source: https://themortgagereports.com/10592/va-streamline-refinance

Postar um comentário for "Can I Use the Va Loan Again After Doing an Irrrl"